All the eyes and ears of the world are focused on Washington, D.C. Watching and waiting to see if a group of 536 (including President Obama) of seemingly inept politicians can navigate the murky waters and avoid teetering on the brink of oblivion.

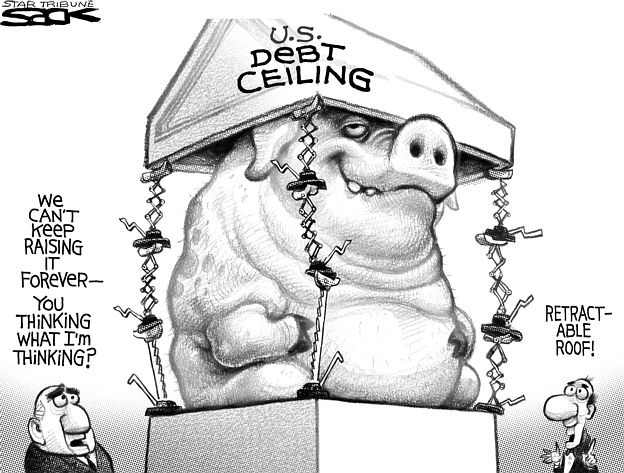

The issues have been long steeped by partisan party politics. The Tea Party Republicans want to “defund” the Affordable Care Act (ACA or Obamacare), while the Democrats want to raise the roof on the debt. They are at an impasse, as we race toward the endgame scenario.

The Issues

The Republicans want to “defund” Obamacare. Like other entitlement programmes, the Affordable Care Act was NEVER funded at all. The individual mandate provision, is what would fund Obamacare. The Republicans are trying to remove the individual mandate, which the U.S. Supreme Court (SCOTUS) upheld as a tax. Accordingly, Congress does have the power to levy taxes. They can also decide to remove taxes. If the individual mandate is removed, this would “defund” Obamacare. Author Larry Burkett in “The Coming Economic Earthquake Warned: “If, in fact, any form of national health care is implemented, it will be the final straw — the dagger in the heart of our economy as we know it.”

The Democrats will NOT reform the entitlement programmes, such as Medicare, Social Security, S.N.A.P. (Food Stamps), Medicaid, Part D Prescription Drug coverage, and HeadStart to name a few. Medicare out-of-pocket copays for 2014 are up over 25% from last year.

Many are asking, what happens if…?

If Congress cannot agree to kick the can down the road some more, what happens? I have no crystal ball, but these are my predictions as an armchair economist:

-

If no compromise is reached, I expect a run on Treasury Bonds. Many large financial institutions have already divested themselves of short term U.S. Government debt. As the demand for U.S. Debt Bonds goes down, interest rates will skyrocket. Suddenly it becomes MORE costly for EVERYONE to borrow, including the Federal Government.

While at the outset, this sounds like a bad thing, in fact it is a good thing for those of us who save, and are currently being punished by historically low interest rates on savings and certificates of deposit. Those who owe money, will lose.

- The credit rating of the U.S. will be lowered. Substantially. Borrowing will collapse, and the reserve currency of the world will be exposed for what is truly is: worthless promises to pay. Perhaps then and only then, will they consider “balancing the budget” and reforming entitlements.

- As the collapse widens, the stock market will take a precipitous nose dive. Think Depression times 10.

- The economy will contract, and deflation (contraction of available money and goods) will ensue. Cash will be king.

- Banks may declare a bank holiday, and all forms of electronic money, will be frozen to prevent a run on the banks.

- Hyperinflation. The Federal Reserve has been propping up the economy by injecting $85 BILLION / month into the system. Known as Quantitative Easing — the house of cards will crumble. Think Germany and a wheel barrow of money to buy a loaf of bread. Hyperinflation is defined as the velocity of money. In other words, money will change hands very quickly since the value of money will contract and shrink.

- Mortgage backed securities, which have been toxic and looming in the economy, will finally be cleansed.

Possible Solutions

Several proposals have been made, which MAY include:

- Cutting discretionary spending (some defense programmes)

- Cutting Social Security and other entitlements

- Raising taxes. (Who knows? We could be the first country to tax itself into prosperity!)

Perhaps a combination of the above. But austerity comes far too late. $16,000,000,000,000 in debt can never be repaid, no matter what solution is proffered. The cycle of madness will continue like a mouse running on a wheel.